Drive Revenue

- Get deposits faster

- Minimize drop-offs during onboarding

- Drive referrals due to great customer experience

Improve Operational Efficiency

- Reduce manual processing time

- Streamline coordination and reduce hand-offs

- Speed up escalation reviews

Improve Quality and Controls

- Eliminate data entry errors

- Provide end-to-end visibility into process

- Enable auditable data controls

Bridging the Journey from Application to Active Customer

Enable a seamless and efficient process for onboarding new customers

Application

Via different channels

Online

Branch

Phone

In-Person

AML KYC

Document and data reviews

IDV

CDD

EDD

Sanctions Screening

Approval

Customer ready for activation

Approval

Final review and account activation

Implementation

Post-AML KYC steps

Profile Creation

Product Enablement

Digital Banking

Communications

Active Customer

Ready to use all services

Fully Activated

Customer journey complete

Automating Post-AML KYC Implementation

Manual Slow Process

- Manual data entry across multiple systems

- Prone to errors

- Difficult to monitor and see status

Often 5-7 business days

Automated Fast Process

- Automated data flows

- Error-free processing

- Full visibility into progress

Same day activation

95%+ reduction in processing time

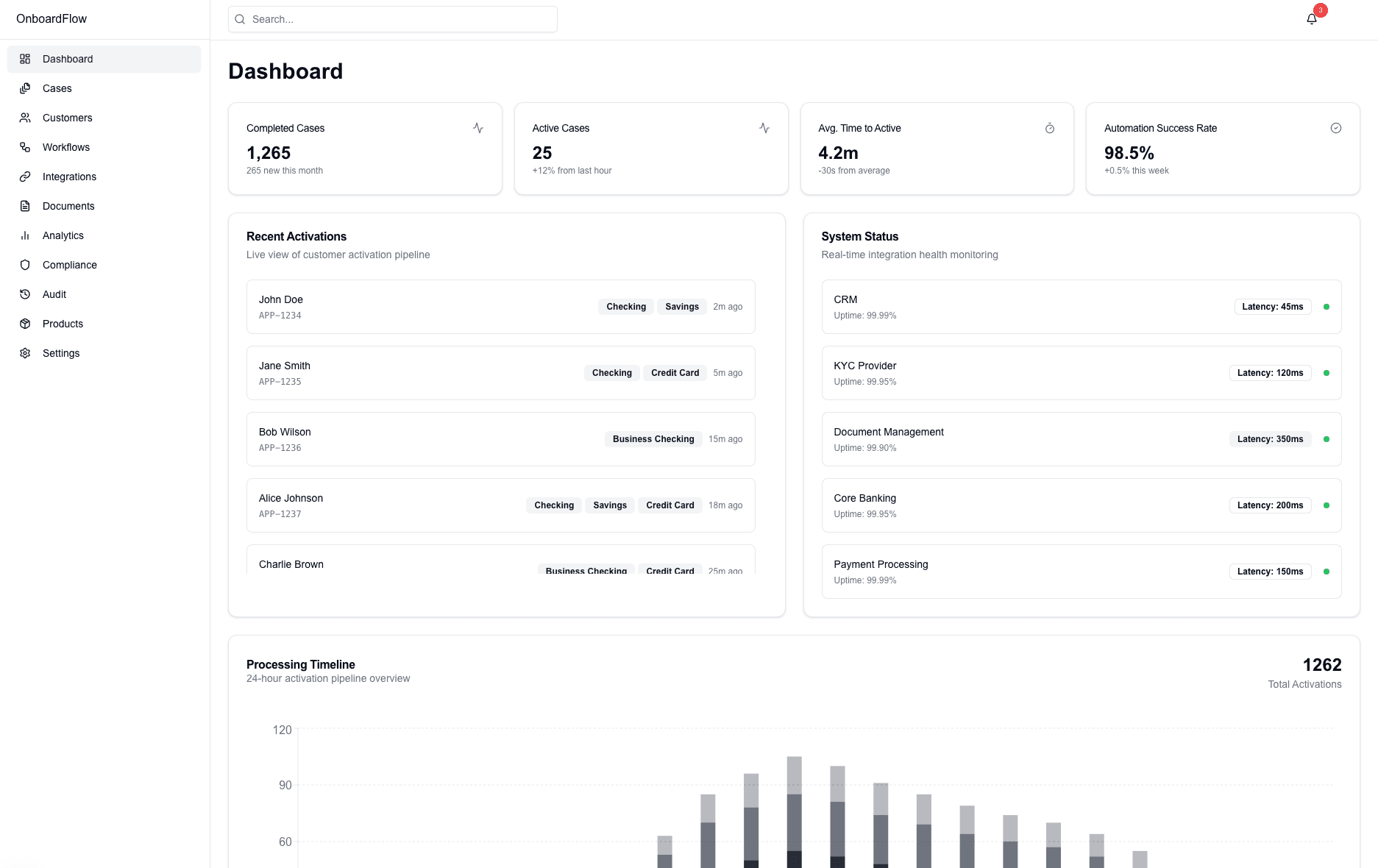

Built for Banking Operations

Transform your post-AML KYC operations with end-to-end automation

Automated Processing

Automate customer profile creation, account setup, and product activation with our intelligent workflow engine.

Instant Visibility

Real-time tracking of every step in the onboarding process with comprehensive analytics.

Secure Integration

Connect securely with your core banking systems, KYC providers, and digital platforms.

From Approved Applicant to Active Customer

Streamline every step after KYC approval with intelligent automation

Minutes, Not Days

Reduce onboarding time from days to minutes with automated account setup and activation.

Reduce Costs

Save $500-1000 per customer by eliminating manual processing and reducing errors.

Improve Experience

Deliver a seamless experience from approval to account access.

Accelerate Revenue

Start generating revenue faster by reducing time-to-activation.